We believe everyone deserves an opportunity to live their best life, get an education, and be healthy and financially stable.

Our mission is to mobilize the caring power of communities to improve health, education, and financial results for low-income children and families. In partnership with California’s local United ways, we advance opportunities for low-income Californians by implementing community impact programs and advocating for policies that help them move up.

1 in 3 California households struggle to afford a decent standard of living. We’re here to change that.

We work to break the cycle of poverty and build a better future for all Californians by strengthening:

Education

Outcomes

to start California youth on a path to a bright future.

Financial Empowerment

to help struggling families move up.

Health

Equity

to enable all Californians to live their best lives.

Over 3.7 million households in California struggle financially, roughly 240% more than reflected in federal poverty statistics.

Latest News

View All

United for Farmworkers, United for ITIN Filers: United Way of Central Eastern California

SUCCESS STORY

Empowering communities with free tax prep

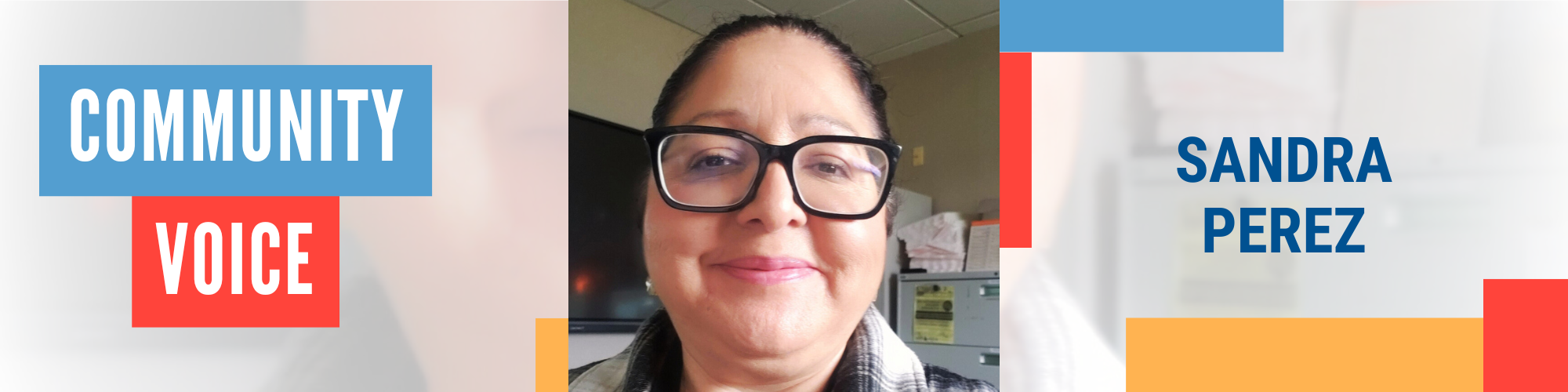

“This is a chance to learn how to do something different, something I have never done before and that can go back to helping my community.”

– Sandra P., a dedicated VITA client turned volunteer, mother of three adult children, and United Ways of California Ambassador, finds joy in supporting others and maximizing their tax benefits through free tax assistance.